Unrivaled Rhythm Adventure Unrivaled New Demos for PC and PS5

In the latest evidence, indie games are often where you find the boldest creative choice, nothing more than Unparalleled. The Hand-Drawn Rhythm Adventure Champion – announced in 2020 and announced the crowdfunding the following year – exudes style and attitude. For example, there is no other way: “Music is an illegal game and you commit crimes.” (Nice) Developer D-cell Games released a new trailer and a more powerful demo on Thursday to let you taste a part of the full game.

Part of “Anime Effect” Unparalleled Follow the protagonist Beat and her “Running Band”. (Good to see that the Wing Reference can still fly in 2025.) The game's narratively driven segment includes conversations with a wide variety of people around town, baseball (played the “wrong way” with Big Hammer and the Catanas), fighting police graffiti marks and nudity to enforce the Draconian anti-Draconian trans laws. (Dicks!) Don't forget some separate time to “think and write new songs.”

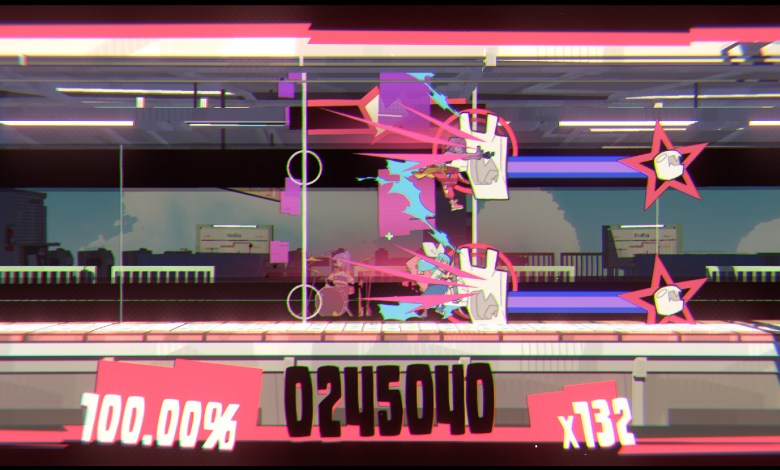

Another part UnparalleledThe gameplay involves rhythm mini-games, which only require two buttons: up and down. Although the mode has been woven into the story, old-fashioned rhythm game fans can enjoy a separate arcade mode, which is a “full gaming experience” that includes challenges and modifiers. ((Rapper Parappa Fans, happy. )

There is no release date yet, but the trailer below shows that D-cell will make full use of these five years of development time. If it looks like your jam, you can steam the demo and PS5 for a spin. (The final version will also be available on Xbox.)

This article originally appeared on Engadget