Inflation dropped to more than 5 years

go through Luisa Maria Jacinta C. Jocson,,,,, Senior Reporter

The Philippine Statistics Agency (PSA) said on Thursday that the title inflation rate dropped to more than five years in the five years in May, as utilities costs rose slowly.

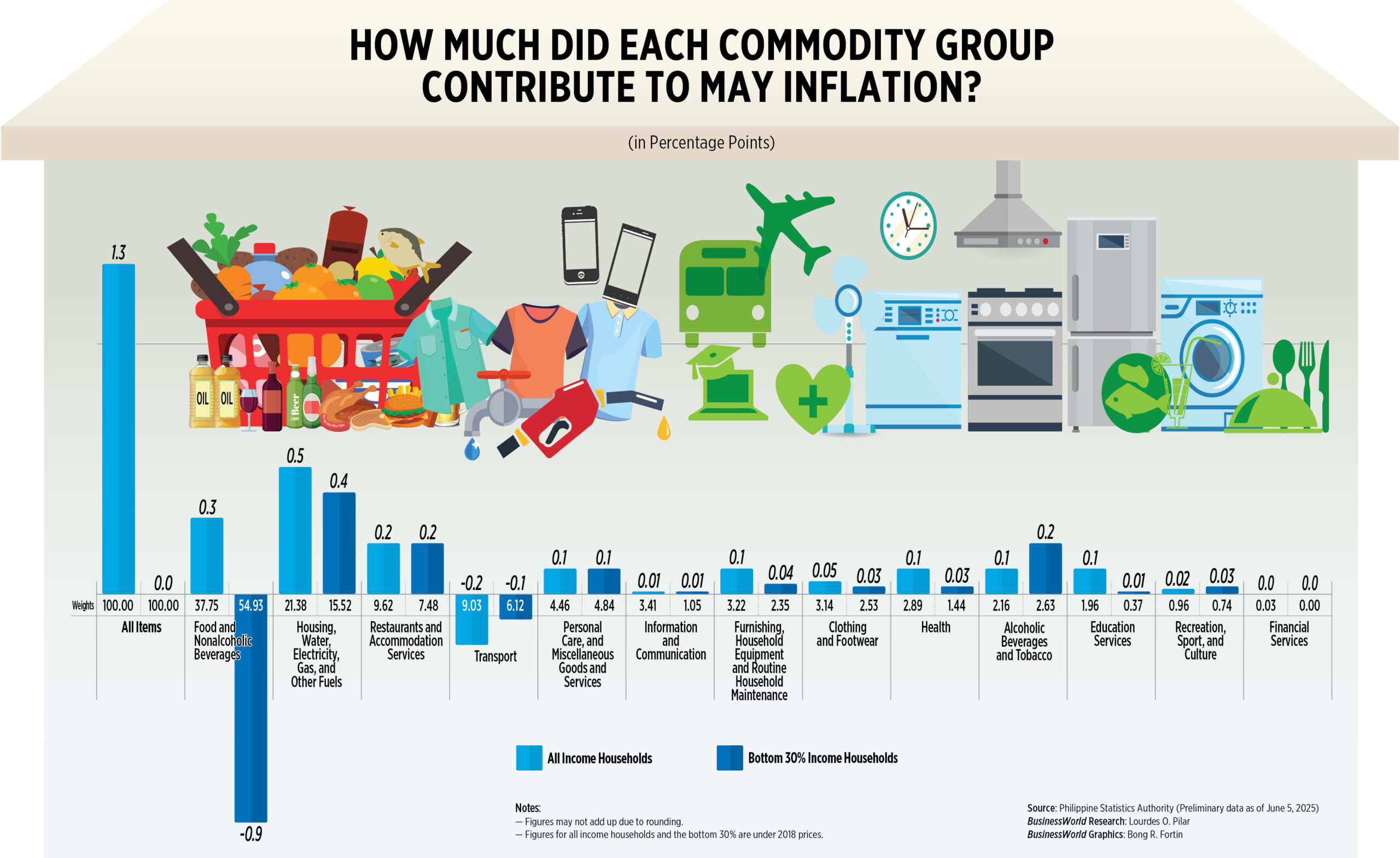

Preliminary data from PSA shows that the Consumer Price Index (CPI) rose to 1.3% in May, slowing from 1.4% in April and 3.9% in the same month a year ago.

This matches the 1.3% median estimate in A BusinessWorld A poll of 17 analysts conducted last week and within the forecast range of 0.9%-1.7% in Bangkok’s Sentral Ng Pilipinas (BSP) this month.

May printing is the lowest inflation rate in five and a half years, or since the 1.2% print released in November 2019.

It may also mark the fourth consecutive month of slowdown and inflation settlement within the target range of 2-4%.

Inflation averaged 1.9% in the first five months. BSP expects inflation to reach 2.3% over the entire year.

Core inflation rate One month ago, the core inflation rate in May stabilized at 2.2% in May. This raises the year-to-date core inflation to 2.3%.

“The latest inflation volume is consistent with BSP’s assessment of the policy-wide management inflation environment, with a revision of the decline in baseline inflation forecasts,” the central bank said.

National statistician Claire Dennis S. Marca (Claire Dennis S.

The index accounts for 68.4% of the month’s downtrend, down from 2.9% in April to 2.3%. This is also the highest index that caused inflation in May, accounting for 37.1% of the share.

Electricity inflation slowed to 2.8% in May from 5.4% a month ago.

After three months of direct rebate, Manila Electric Co.

Water costs in May also fell to 5.7% from 6.3% last month.

The May shipping index fell from 2.1% a month ago to 2.4% in May. This is because starting from 68.8%, the inflation rate of passenger transport for passenger transport has dropped to 42.4%.

Gasoline prices also fell from 12.4% in April to 13.2% in May, while diesel fell 8.3% a month ago to 9.3%.

The restaurant and accommodation service index also fell from 2.3% in April to 2% in May.

Meanwhile, the weight-weighted food and non-alcoholic beverage index continues to be the main contributor to inflation this month, accounting for 25.7% of the overall print.

The index has stabilized at 0.9% from May starting in April and food inflation has also remained at 0.7%.

The price of pork accelerated to 11.9% from 10.3% in April. This is the largest contributor to the CPI in May, contributing 25% or 0.3 percentage points.

Rice inflation remained negative, falling to 12.8% in May from 10.9% a month ago.

Mr Mapa added: “The average (rice) inflation rate is -7.7% from January to May. So, in the first five months of 2025, this is negative and there is expectation that it will continue to be negative in the coming months as we see the price of rice drop by a drop per kilogram.”

Meanwhile, inflation in the National Capital Region (NCR) fell to 1.7% from 2.4% in April. Outside the NCR, inflation remained stable at 1.2% in May.

Zero inflation

Meanwhile, the lowest 30% of income households went public from 0.1% in April and 5.3% a year ago.

This reduces annual inflation from a minimum of 30% to 1%.

The lowest 30% of food and non-alcoholic beverages fell to 1.6%, accounting for 83.6% of the share. Transport inflation also fell by 1.9%, with a share of 11.6%.

“The main contributors are food, especially grains. The minimum 30% of rice is -14.7%. So this is a significant drop,” Mr Mapa said.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., noted that rice prices constitute the majority of the lowest 30% CPI.

“Because the poorest Filipinos have a larger budget allocation for rice and other essential necessities, they are the biggest beneficiaries of lower rice prices and they are eligible for use,” he said.

Inflation prospects

Meanwhile, BSP said that from this year to 2027, the risks of inflation outlook continue to remain broadly balanced.

“Up toward pressure may come from increased shipping costs, meat prices and utilities,” it said.

“At the same time, downside risks are related to the ongoing impact of lower tariffs on rice imports and the expected impact of weaker global demand.”

Rosemarie G. Edillon, Deputy Minister of Policy and Programs of the Ministry of Economics, Planning and Development, is optimistic that inflation will remain within the band 2-4% this year.

“We remain committed to implementing the necessary measures to keep prices low and stable,” she said in a statement.

She added that the government will implement “targeted policies aimed at reducing inflationary pressures and maintaining the purchasing power of households in the Philippines.”

As far as agriculture secretary Francisco P. Tiu Laurel (Jr.), he said efforts were being made to ensure that rice prices remain included.

“We are expanding coverage of the P20 rice program and are studying the suggested retail price of imported rice, which is the dominant Filipino table, especially among the poor,” he said in a statement.

Mr Tiu-Laurel said the President has directed the Ministry of Agriculture to implement the subsidized rice initiative by June 2028.

Cut higher fees?

Meanwhile, BSP said there is still room for its loose road despite external winds.

The Monetary Commission marks a challenging external environment that could “destroy global growth prospects, thereby posing a downside risk to global commodity prices and domestic economic activity.”

It added: “Overall, the easier-to-manage inflation outlook and downside risks of domestic economic activity have shifted towards a looser monetary policy stance.”

The Monetary Commission in April lowered interest rates by 25 basis points (BPS), bringing the benchmark to 5.5%. It has cut borrowing costs by 100 basis points since the relaxation cycle began in August.

“Slow food and utility inflation and transportation costs have lowered the title. It looks like the BSP is opening to lower the tax rate in June,” said Nicholas Antonio T. Mapa, senior economist at Metropolitan Bank & Trust Co.

Miguel Chanco, chief emerging Asian economist at Pantheon macroeconomics, said they expect central banks to cut another $2.5 billion later this month.

“We persistently believe that the benchmark rate of BSP will end at a rate of 4.75%, which means three 25 bp reductions, including the next in two weeks.”

BSP Governor Eli M. Remolona, Jr. It said that during the Monetary Commission’s June 19 policy review, 25 yards were cut on the table.

On the other hand, Aris D. Dacanay said central banks could consider keeping interest rates stable.

“Our baseline situation is that BSP suspended its slow cycle in June as central banks await more details on the proposed tariff measures in the United States,” he said.

“In view of the damage the economy has to do with any trade, BSP does have the right to take a measure.”

However, Belot targeted inflation increased the chances of June cuts, especially in the fourth quarter, expecting weaker growth.

“The relative strength of the peso may also give the BSP room a way to lower policy rates, regardless of whether the Fed lowers interest rates. That said, the June Monetary Commission meeting could be a tough call.”

Other inflation risks that need to be monitored that need to be monitored include requiring P200 comprehensive minimum wage for private sector workers, which was approved by the House in Wednesday’s third and final reading.

Mr Dacanay added: “In addition, policy makers are considering the possibility of increasing tariff rates for rice based on seasonality of crops. If this is achieved, the inflation outlook could have a big impact, enough for BSP to rethink the pace of its easing cycle.”