Dimitrov returns to Paris Tour with dominant victory – Tennis Now

It’s like he never left…

Grigor Dimitrov left Wimbledon in tears after being forced to withdraw with a torn pectoral muscle two sets ahead of eventual champion Jannik Sinner.

The 34-year-old returns after more than three months and has shown good form. He defeated Giovanni Mpehi Perikad 7-6(5), 6-1 and set up a second-round match against either Jaume Munar or Daniil Medvedev.

It was an outstanding performance from start to finish for the former Paris finalist.

“It’s never happened to me, so I guess I’m still trying to concentrate away from the pitch,” Dimitrov said after his win at the Arena La Défense. “It’s never easy. I knew going into the competition it was going to be a tough task. I just wanted to come out and test myself and give myself a chance.

“It was a good night. I’m taking it and just taking it one day at a time now.”

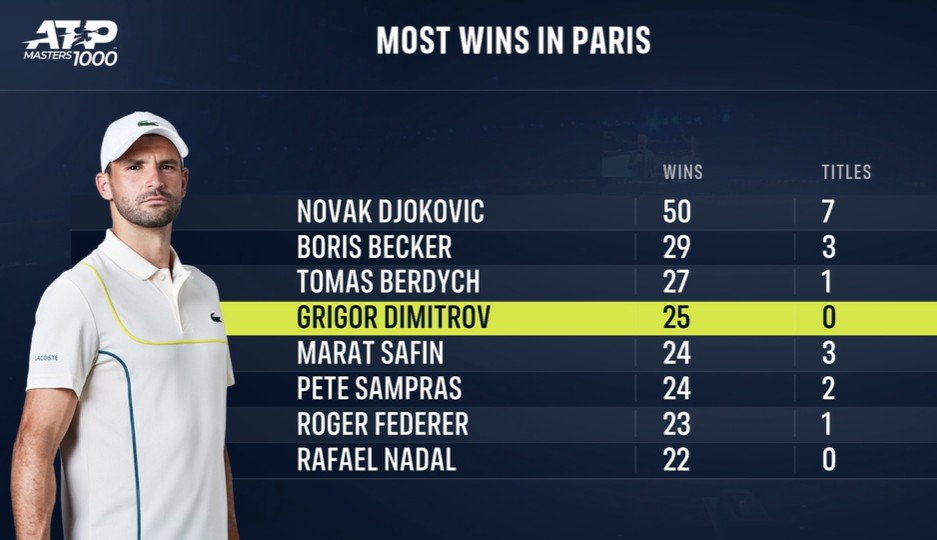

With 26 winners and three breaks in a match, Dimitrov is one of the most lethal servers in the game. He hit 16 forehand winners and scored 16 of his 21 points at the net to improve his season record to 18-11 and his career record in Paris to 25-12.

Dimitrov is one of four players to win 25 matches at the Paris Masters, along with Novak Djokovic, Boris Becker and Tomas Berdych.

In other action, 2018 champion Karen Khachanov ended the night with a 6-1, 6-1 victory over Ethan Quinn in 60 minutes.

American Tenn earned his first victory in Paris with a straight-sets victory over Nuno Borges, while Brandon Nakajima (lost to Mueller), Sebastian Korda (lost to Sonego) and Alexander Kovacevic (lost to Keikmanovic) fell.

Andrey Rublev ended a five-game losing streak with a 6-1, 6-4 victory over British qualifier Jacob Fearnley.

Carlos Alcaraz will face Cameron Norrie on Tuesday.

See the full Day 2 match order below: