Gay marriage pioneer Sullivan criticizes new directions for LGBTQ movement

NewYou can listen to Fox News articles now!

These days I keep hearing a saying: Win.

It can be applied to anyone – Donald Trump, Chuck Schumer, AOC – to win and then insist on asking for more, no matter how unrealistic it is.

What comes to mind is an extraordinary paper by Andrew Sullivan in the New York Times.

Gay journalists say LGBTQ movement has shifted from civil rights success to “crazy”

It was Sullivan, a gay, conservative British Catholic who ran the New Republic – who first made a case for homosexual marriage in 1989.

“As gay people openly admit that their love has become more acceptable, more people are committed to one another for life. Their family and friends are committed to one another for life. Law institutionalizing gay marriage will only enhance healthy social trends.”

The cover story is very unpopular and is regarded as an extremist. Despite his optimism, many gays remained closed, including in the media, for fear of an impact.

Before Bill Clinton, gay men in the army were resigned or military court. Therefore, Sullivan’s dream is seen as a distant fantasy.

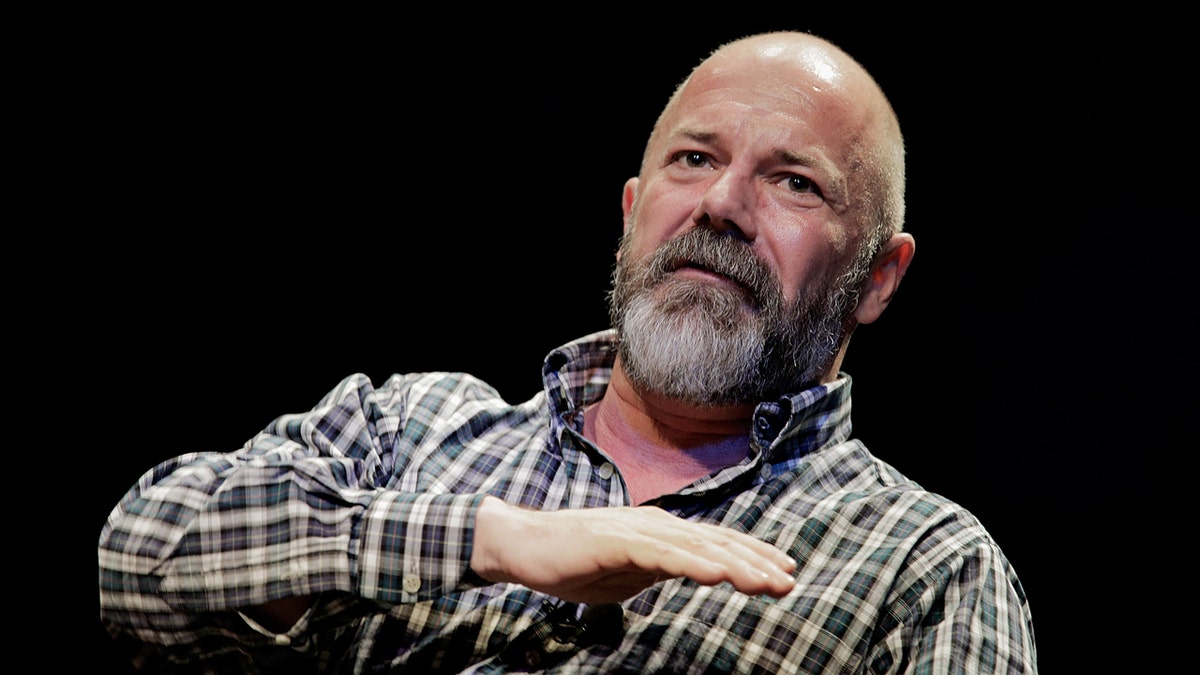

Andrew Sullivan, an openly gay conservative and long-time voice in the movement, wrote a great work on the current status of the New York Times. (Joshua Stanyer/sopa image/lightrocket via Getty image)

“This is the weirdest idea ever. Why do we still talk about it?” Christian conservative Gary Bauer said on Crossfire.

In the spring of 1996, Andrew came to me and asked me to break his story of AIDS, partly because of his resignation as editor of the New Republic. He said he knew he had the disease for three years but was in good health.

“It’s a terrible burden,” he told me. “It’s hard to fight disease, but when there’s a secret, you can’t help but hide the feeling of shame and inwardness, and it just destroys you.”

The nation’s largest Protestant denomination calls for overturning Supreme Court decision to legalize same-sex marriage

Sullivan was a pioneer in the gay rights movement – he first proposed a case of same-sex marriage in 1989. (TJ Kirkpatrick/Getty Images)

Until 2015, after 37 states had taken action (some overturned), the Supreme Court made same-sex marriage a land law. When heterosexual couples realize that their marriage is not affected, it gradually fades into a hot political issue.

Polls now show that one in 10 Americans support gay marriage. Gays are now openly served in cabinets and state houses.

In the times, Sullivan is still in good health, “with the victory of civil rights, it is not more decisive or comprehensive than that.”

The problem is that it has received a lot of media playback because it is the 10th anniversary of the SCOTUS ruling.

But now it’s overdoing.

Rather than announcing victory and closing the shop, the movement leaned in a dangerous new direction.

Sullivan said he always supports the civil rights of trans people. I feel the same way.

But as money is invested, gay rights groups are trying to replace the difference between men and women with “gender identity” – meaning gender-changing surgery on minors. This is a question that about 80% of the country object.

Attorneys leading the SJSU transgender lawsuit respond to controversial investigations into misconduct by trans athletes

With an obsession with pronouns, the movement also supports getting trans women into the women’s movement, another issue that most people think is unfair and treat it as men.

According to Sullivan, the new mantra: “Transex women are women. Trans men are men.” President Trump has ordered transmilitary members to start from service.

According to those at the Sullivan Thought Academy, this is another albatross of the modern LGBTQ movement: It is unwaveringly committed to trans issues. (Stephanie Keith 100584/Getty Images)

Sullivan, a fan of the president, said some activists opposed everything Trump supports.

“Dissors of gender ideology are usually unfriendly, avoid and humiliate. Almost all homosexuals, trans and lesbians confide in me [say] They disagree with this…

“Shut the kids out. We are very aware that any excess there can cause the oldest slander against us: we want to embellish and abuse our children.”

Subscribe to Howie’s Media Buzz Podcast, the improvisation of the hottest stories of the day

This is one person’s opinion; Sullivan allows him to “just another old fart.”

As if to emphasize his point of tolerance, a poster on Reddit called the piece “incoherent Mishmash” and said Sullivan was “accusing Trans and LGBTQ+ activists of conservative attacks on the Trans community.” This comes from “an aging gay man whose brain is soaked in prejudice and fear”.

Click here to get the Fox News app

Many people may disagree with Andrew Sullivan’s analysis. Republican support for same-sex unions is less than 50%. But as the first person to join a gay marriage 36 years ago and to openly discuss his battle with HIV, I say he won the right to be heard.