Steve Huffman says Reddit should be the “first search engine”

Reddit will work harder to search in the coming months. The company is already developing plans to integrate its LLM-powered search into its main search capabilities, but CEO Steve Huffman said he wants users to see the website as an actual search engine.

Hoffman said searching is one of Reddit’s top priorities in the company’s latest earnings call. “We focus our resources on areas that will bring results to our most pressing needs, improve core products, make Reddit the search engine of choice and expand internationally.”

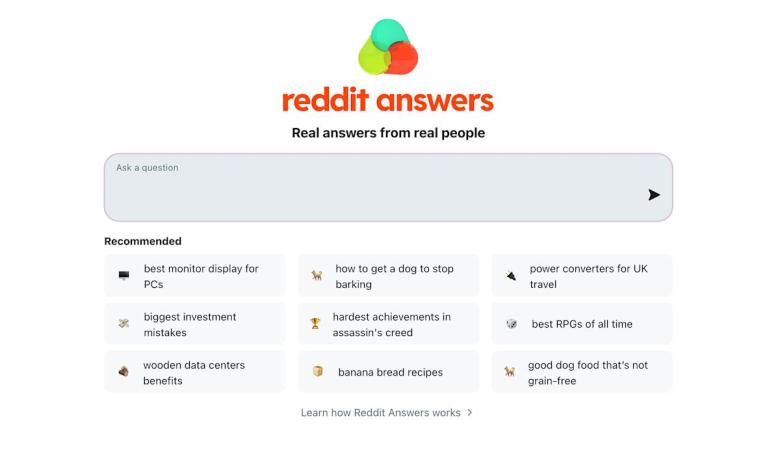

Reddit’s idea as a search engine is not that far-fetched. Many people have become accustomed to adding “reddit” to traditional searches in the hope of finding relevant threads from the website. The company has been trying to take advantage of this with its own AI-powered search products. Although the feature is still marked “Beta” in “Beta”, the company plans to eventually add it to the default search bar.

“Our focus now is on unifying Reddit searches, such as traditional searches on Reddit, which are very widely used in Reddit, and the new Reddit Answers Answers products … we unify them into a single search experience, and we will bring that aspect and center in the app.”

Hoffman’s comments are at a time when AI is increasingly used on websites. It sounds like Reddit, with millions of dollars in data licenses, and it is also impossible to protect against these trends. During the call, Hoffman said Reddit’s search traffic from Google was “different every week”, but overall it was a headwind last quarter.

This may help explain why Huffman is so eager to use Reddit itself as a search destination, even if the company continues to license its data to AI companies. “AI does not invent knowledge,” he said. “It learns from us; share real perspectives from real people.”